Don't miss our holiday offer - up to 50% OFF!

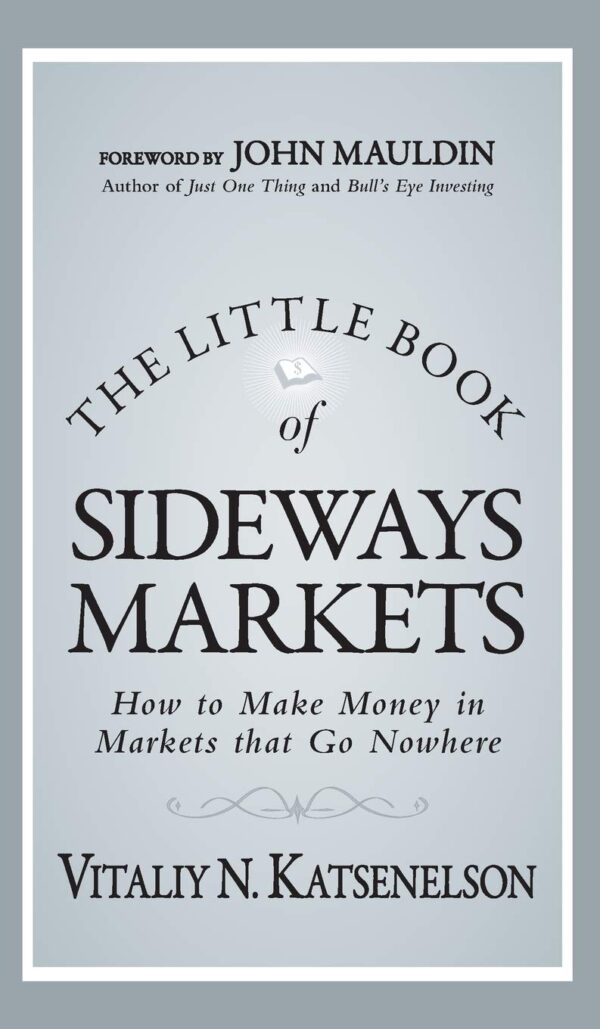

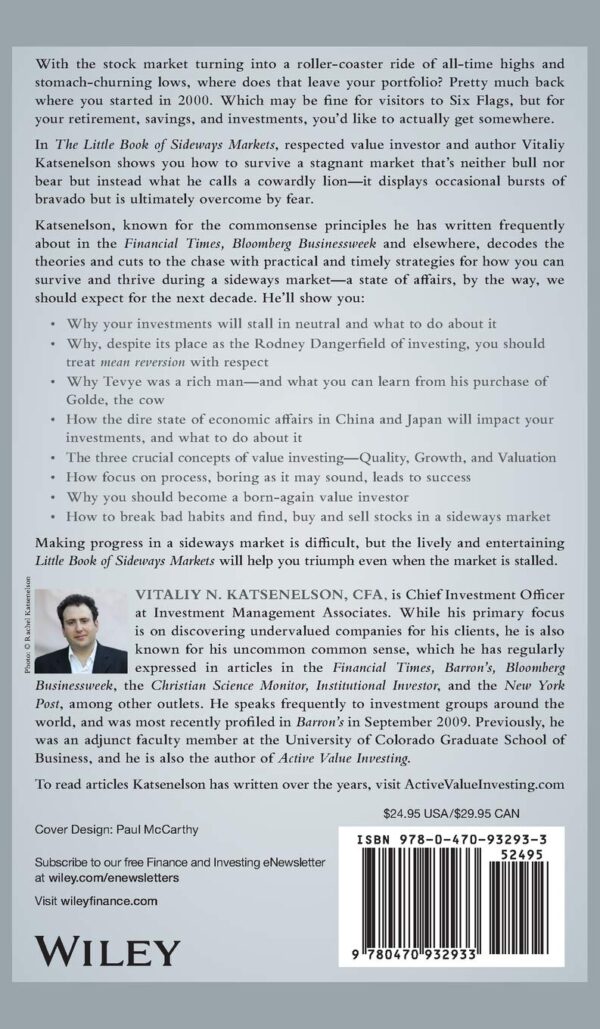

The Little Book of Sideways Markets: How to Make Money Online…

Original price was: $24.95.$15.18Current price is: $15.18.

Price: $24.95 - $15.18

(as of Nov 18, 2024 21:33:27 UTC – Details)

“It is difficult to talk clearly about investing and at the same time make sense to ordinary readers. Katsenelson gives a lucid explanation of today's markets with good advice on how to make money while avoiding the traps that the market sets for both exuberant bulls and bears. scared alike.” — Thomas G. Donlan, Barron's

“A thoroughly enjoyable read. Provides a clear framework for investing in shares in today's volatile and 'sideways' markets, useful for everyone. Clear thinking and clear writing don't often go together – well done!” — Dick Weil, CEO of Janus Capital Group

“The Bible on how to invest in the most tumultuous financial market environment since the Great Depression. A true guide to building wealth prudently.” — David Rosenberg, chief economist and strategist, Gluskin Sheff + Associates Inc.

“A wonderful, informed read for new and experienced investors, Katsenelson explains in plain language why volatility and sideways markets are a stock picker's best friend.” — The Motley Fool, www.Fool.com

Praise for active value investing

“This book reads like a conversation with Vitaliy: deep, insightful, inquisitive and civil.” — Nassim Nicholas Taleb, author of The Black Swan

Q&A with author Vitaliy N. Katsenelson

What approach do you recommend taking in lateral markets?

What I propose in the book (and what I practice in life) is active value investing. Rather than being a market timer, I am a buy and sell investor, focusing on valuing individual stocks.

Find stocks that fall within your circle of competence, analyze them to see if they meet your qualitative criteria (such as competitive advantage, strong balance sheet, high return on equity, shareholder-friendly management, etc.), value them, determine an appropriate price . margin of safety (discount on fair value, which should be increased in range-bound markets) and therefore you will arrive at a price at which you would want to buy them.

If a stock is trading at or below your purchase price, buy it; If not, put it on your watch list. When the shares reach their fair value level, you don't hold them, you sell them. Repeat this process over and over.

What is one piece of advice you would give to readers about investing in sideways markets?

An investor makes money from stock appreciation and dividends. Stock appreciation is driven by P/E expansion and earnings/cash flow growth. If you see an apparent catalyst (news or event) that will force the P/E to rise, great! But in my experience I have found that it is the apparent absence of a catalyst that creates an undervaluation. Wall Street is pretty short-term oriented, so if the stock is undervalued but there is no reason or catalyst to help it rise in the next quarter or two, sell.

This is what I propose. Buy stocks that grow earnings and pay dividends; This will put time on your side: you will get paid to wait.

Earnings growth is compressing the stock's P/E, and the dividends are a real-time payment for your patience. If a company isn't growing earnings and paying few dividends, make sure the undervaluation (potential P/E expansion) is significant, or that there is a clear catalyst, as time is not on your side in this case. For example, if you find a stock that's 20 percent undervalued, with no catalyst, no dividend, and no earnings growth, it's probably not worth buying.

What not to do when it comes to investing in sideways markets?

We need to protect ourselves from the outside world. I'm not recommending moving into a cave without electricity. But we must not allow the outside to enter our lives without control. If we do, the market will become our master and dictate what we do, which is the opposite of what we should be doing. I actively try to isolate myself from market influences. I found that the most productive time I have is on airplanes, because I can write and think for hours; there is little interference from the outside world. I really make an effort to check my stock prices only a few times a day. I haven't perfected this yet: we all have bad habits that take time to break. But if we are aware of the negative influences that the outside world can have on us, there may be hope for changing our behavior.

I usually try to read newspapers and keep up to date with the news before I get to the office. Then I try (still an effort) to turn off the Wi-Fi switch on my laptop; This kills the Internet, including email, Skype, instant messaging, and RSS feeds. I try to recreate an airplane-like environment at work. I don't turn on the television during the day. And when I tune back in, I try to listen to more podcasts and watch more PBS and less commercial TV. So to answer your question, I think we should create an environment where the outside world does not change (reduce) our time horizon.

From the brand

The Little Books, Big Profits series includes powerful, practical financial advice from some of the industry's top influencers in a small but powerful package. The series presents financial strategies in general and understandable terms and is perfect for investors of all levels looking to make smart decisions in the financial market.

Buy more small books

Buy more small books

Buy more small books

Buy more small books

Buy more small books

Buy more small books

Buy more small books

Publisher : Wiley; 1st edition (December 7, 2010)

Language : English

Hardcover : 256 pages

ISBN-10 : 0470932937

ISBN-13 : 978-0470932933

Item Weight : 2.31 lbs

Dimensions: 5.3 x 1.2 x 7.2 inches

Reviews

There are no reviews yet.