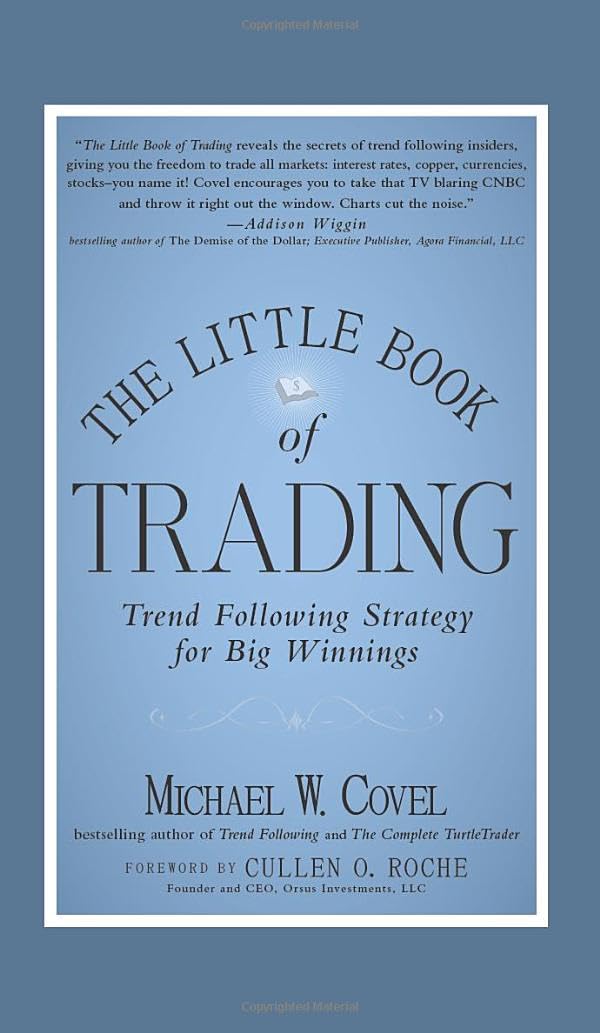

The Little Book of Trading: Trend Following Strategy for Big…

$28.00 Original price was: $28.00.$19.79Current price is: $19.79.

Description

Price: $28.00 - $19.79

(as of Jun 25, 2024 15:08:00 UTC – Details)

How to overcome the crisis and make the market work for you again

The last decade has left people terrified of even the safest investment opportunities. This fear does not help potential investors who could be making money if they had a solid plan. The Little Book of Trading teaches the average person the rules and philosophies that winners use to beat the market, regardless of the financial climate.

The market has always fluctuated, but smart traders know how to make money in good times and bad. Drawing on author Michael Covel's own trading experience, as well as the insights of legendary traders, the book offers sound, practical advice in an easy-to-understand and digestible way. The little book of commerce:

Identify tools, concepts, psychologies and philosophies that keep people protected and making money when the next market bubble or surprise crisis occurs. It features top traders in each chapter who have beaten the market for decades, giving readers their knowledge on how to make money. It shows how traders beat mutual funds. Performance makes money at different times, not just with stocks.

Most importantly, The Little Book of Trading explains why mutual funds should not be the investment vehicle of choice for people looking to secure their retirement, a radical insight that highlights the shift in investing today.

Table of Contents:

Chapter One: Stick to Your Weave (Gary Davis, Jack Forrest, and Rick Slaughter).

Chapter two: Someone has to lose for you to win (David Druz).

Chapter Three: No Guts, No Glory (Paul Mulvaney).

Chapter four: In a land far, far away from Wall Street (Kevin Bruce).

Chapter Five: Think Like a Poker Player and Play the Odds (Larry Hite).

Chapter Six: Get up, dust yourself off and move on (David Harding).

Chapter Seven: Throw Out the Fundamentals and Stick to Your Charts (Bernard Drury).

Chapter Eight: Study Hard and Get an A+ (Justin Vandergrift).

Chapter Nine: You Can't Know Everything (Eric Crittenden and Cole Wilcox).

Chapter Ten: Make it work in all markets (Michael Clarke).

Chapter Eleven: Stay in the Now Moment (Charles Faulkner).

Chapter Twelve: Sing the Whipsaw song.

Q&A with author Michael Covel

Author Michael Covel What is trend trading?

Trend following is a very simple trading strategy that ignores the fundamental information for buying and selling in all markets. For example, imagine you have no idea how a market will develop or for how long. Trend followers simply say that if Apple trades at the 300 price level and starts to rise, buy Apple. Why would you do this? If Apple is going up, you'll want to be on board. Period. No one knows how high or low Apple can go, but if it goes from 300 to 400 you won't want to miss out, even if 300 seems like too high a price to buy. Buying cheap or cheap is not the goal.

After buying, if everything goes in the opposite direction and you start losing money, you leave. How do you know to go out? Trend followers respect certain universal and timeless rules that date back 100 years. If you lose a small amount of money because the trend is not going your way, you exit. The key to keeping that loss as small as possible is to admit defeat. This is how you preserve capital while waiting for the next big unpredictable money-making trend to come along.

Why do you recommend a trend following strategy instead of a more traditional form of trading?

This is the great thing about following trends: you don't need to know the fundamentals that make up a stock or commodity to make money from it. It is not necessary to know what the demand for the next iPad will be. It is not necessary to know how much gold will rise or fall, or why. That information is irrelevant. The only variable you need to understand, in order to make money, is which direction the market is trending and whether you are on board, up or down, in that direction. This puts you on a much more level playing field with banks and hedge funds, who clearly have more fundamental knowledge than you could even dream of accumulating.

Plus, unlike mutual funds, wealth-building trend trading means you can make money when the market goes up or down. This is a huge advantageous difference from most other strategies used in the markets.

Who can benefit from reading The Little Book of Trading?

Any natural person, regardless of whether they are currently contributing or not. The Little Book of Trading is for those who are open and willing to learn a different and less conventional way of making money. It is for those who are curious to know how some of the top traders are thriving profitably during these uncertain times. It is a roadmap for an uncertain future.

While writing the book, he talked to many different merchants. Is there anything that stands out to you in your conversations?

If you learn anything from my Little Book, let it be a simple lesson: keep going. There will always be distractions; Banners of breaking news, surprises and unpredictable chaotic events, but you won't get carried away. The most important lesson that these top traders drilled into my head, and wanted me to convey to the readers, was that they don't pay attention to any of that. They have discovered, through hard work, diligent study, and perhaps putting a little luck on their side, that their ability to follow a trading plan is far more important than knowing or caring about what their neighbor is doing, what they will do. the Federal Reserve next, or if it is raining or snowing in some obscure rice plantation, in some random country.

What advice would you give to someone looking to follow trends?

Do your homework. This is not buy and hold: buy and forget. You have to have a strategy in place that will catch you in and take you out, otherwise they will take all your courage (i.e. 2008). If this means you have to practice trading over a period of time to understand all the details, so be it. You can't stick to a strategy you don't have, so lay a smart foundation.

What's wrong with mutual funds?

The investment world has been seduced by the idea that you can buy and hold a mutual fund for a lifetime, rewarding you with huge savings when you retire. Just buy, wait and forget, they tell us. That pipe dream has been sold by a mutual fund marketing machine and they hire serious lobbyists in Washington, DC. to keep you “in line”. However, mutual funds have gone more than a decade without returns, while simultaneously mutual fund owners have earned billions in fees. How smart does that seem to you? More importantly, what will happen when the next bubble bursts? What if the government can't burst the bubble again? That is the million dollar question and the question that decides how much money you will earn throughout your life.

Of the brand

The Little Books, Big Profits series includes powerful, practical financial advice from some of the industry's top influencers in a small but powerful package. The series presents financial strategies in general and understandable terms and is perfect for investors of all levels looking to make smart decisions in the financial market.

Buy more small books

Buy more small books

Buy more small books

Buy more small books

Buy more small books

Buy more small books

Buy more small books

Publisher : Wiley; 1st edition (August 9, 2011)

Language : English

Hardcover : 256 pages

ISBN-10 : 1118063503

ISBN-13 : 978-1118063507

Item Weight : 12.7 ounces

Dimensions: 5.2 x 1 x 7.1 inches

Related products

-

Sale!

Sale!

Reduce your taxes – BIG TIME! 2023-2024: Wealth for small businesses…

0 out of 5$26.00Original price was: $26.00.$19.08Current price is: $19.08. Buy Now -

Sale!

Sale!

Fraud audit and forensic accounting

0 out of 5$105.00Original price was: $105.00.$48.34Current price is: $48.34. Buy Now -

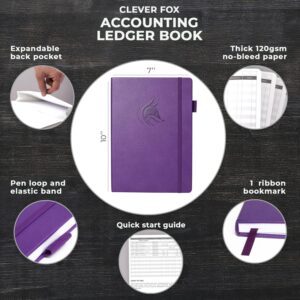

Clever Fox Accounting Book – Accounting Book for Small…

0 out of 5$22.99 Buy Now -

Premium 12 Digit Commercial Large Desktop Calculator with…

0 out of 5$13.99 Buy Now

Reviews

There are no reviews yet.