The small-cap advantage: How leading foundations and endowments are helping small-cap companies…

$52.00 Original price was: $52.00.$38.21Current price is: $38.21.

Description

Price: $52.00 - $38.21

(as of Jul 17, 2024 16:53:19 UTC – Details)

World-renowned money manager shares winning strategies for investing in small stocks

Since forming Bares Capital Management, Inc. in 2000, Brian Bares has demonstrated that above-average returns can be generated by carefully selecting small-company common stocks. In addition, he has shown how concentrating capital on a handful of ideas enhances the potential for outperformance by increasing the depth of knowledge of each position and allowing each security to have a more significant impact on the portfolio. In The Small-Cap Advantage: How Top Endowments and Foundations Turn Small Stocks Into Big Returns, Bares describes how endowment model investors and aspiring managers can gain significant exposure to small-company stocks while circumventing many of the obstacles that have historically impeded institutional investment in the asset class. The book also provides a comprehensive overview of the small-company stocks and their impact on the portfolio.

Details the historical outperformance of small-cap stocks. Contrasts the various strategies employed by managers in the space. Explains how aspiring managers can structure a company to drive performance and attract institutional capital. Describes how endowment model institutions can evaluate and hire outside managers for their small-cap assignments. Summarizes important topics such as liquidity and the research process.

Bigger is not better. The small-cap advantage reveals that small-cap stocks have historically outperformed large-cap stocks, and the lack of competition in these stock classes offers diligent managers a unique opportunity to outperform.

Publisher: Wiley; 1st edition (February 2, 2011)

Language : English

Hardcover : 208 pages

ISBN-10 : 0470615761

ISBN-13 : 978-0470615768

Item Weight: 13.4 ounces

Dimensions: 6.2 x 0.72 x 9.3 inches

Related products

-

Sale!

Accounting for Non-Accountants: Financial Accounting Made Si…

0 out of 5$17.99Original price was: $17.99.$9.99Current price is: $9.99. Buy Now -

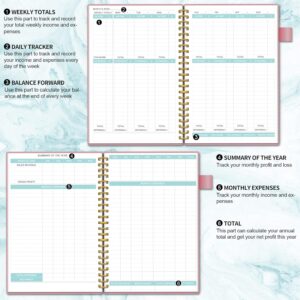

Income and expense tracker, accounting and accounting book…

0 out of 5$7.99 Buy Now -

Sale!

Sale!

The Little Book of Trading: Trend Following Strategy for Big…

0 out of 5$28.00Original price was: $28.00.$19.79Current price is: $19.79. Buy Now -

Accountant Gifts for Women, Men, Boss, Gifts for Accountant…

0 out of 5$16.99 Buy Now

Reviews

There are no reviews yet.